2024 Federal Tax Brackets Married Joint. Below are the tax brackets for 2024 taxable income. 1 percent to 12.3 percent california has nine tax brackets, ranging from 1 percent to 12.3 percent.

Married couples filing a single joint return together; Tax rate single married filing jointly married filing separately head of household; The irs uses different federal income tax brackets and ranges depending on filing status:

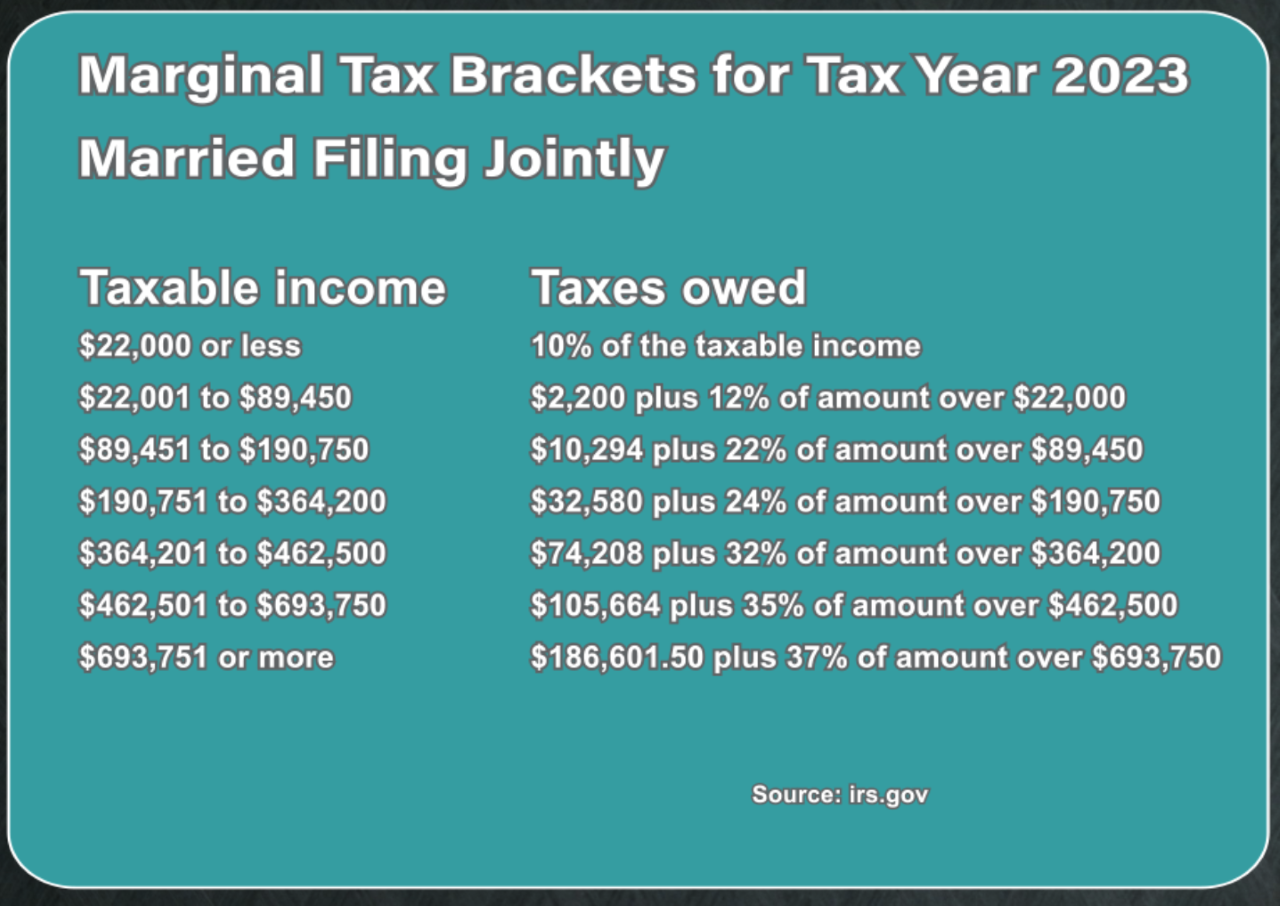

2023 Federal Income Tax Brackets And Rates For Single Filers, Married Couples Filing Jointly, And Heads Of Households;

10%, 12%, 22%, 24%, 32%, 35% and 37%. Find out your 2024 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married.

The Irs Uses Different Federal Income Tax Brackets And Ranges Depending On Filing Status:

Anyone with an adjusted gross income of up to $79,000 can file their federal tax returns (and some state returns) for free using the irs’s free file system.

2024 Federal Tax Brackets Married Joint Images References:

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For tax year 2024, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses:

Source: mungfali.com

Source: mungfali.com

Tax Brackets 2022 Chart, In total, a married couple 65.

Source: modernhusbands.substack.com

Source: modernhusbands.substack.com

The 2023 Tax Brackets by Modern Husbands, Tax rate for single filers for married.

Source: www.chime.com

Source: www.chime.com

Tax Season Guide Married Filing Jointly vs. Separately Chime, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: www.bluechippartners.com

Source: www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners, Based on your annual taxable income and filing status, your tax.

Source: www.hotzxgirl.com

Source: www.hotzxgirl.com

Tax Brackets Irs Married Filing Jointly Hot Sex Picture, In total, a married couple 65.

Source: www.tigerdroppings.com

Source: www.tigerdroppings.com

Explain federal tax brackets to me… Money Talk, As your income goes up, the tax rate on the next layer of income is higher.

Source: www.purposefulfinance.org

Source: www.purposefulfinance.org

IRS 2021 Tax Tables, Deductions, & Exemptions — purposeful.finance, Married couples filing a single joint return together;

Source: projectopenletter.com

Source: projectopenletter.com

What Are The Tax Brackets For 2022 Married Filing Jointly Printable, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: oakharvestfg.com

Source: oakharvestfg.com

IRS Tax Brackets AND Standard Deductions Increased for 2023, They also both get an additional standard deduction amount of.

The Irs Uses Different Federal Income Tax Brackets And Ranges Depending On Filing Status:

2023 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households; Find out your 2024 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married.

The Highest 37% Tax Bracket Starts At $609,350 For Single Individuals And Heads Of Household In 2024, Up From $578,125 Or $578,100, Respectively, In 2023.

Based on your annual taxable income and filing status, your tax.

Posted in 2024